The Internal Revenue Service considers crypto a digital asset, not foreign money, for tax functions. Thus, investing in crypto ETFs would doubtless contain similar tax obligations to investing instantly in cryptocurrencies. However, it’s at all times prudent to consult a tax advisor for advice in your explicit tax situation, particularly within the quickly transferring regulatory setting involving cryptocurrencies. Cryptocurrency index buying and selling permits traders to purchase, sell, or swap a set of cryptocurrencies in one click. This replaces the tedious process of purchasing and selling every individual coin separately. By investing in a crypto index, inventors can even rapidly diversify their cryptocurrency portfolio.

Securities and Exchange Commission (SEC) has long hesitated to approve crypto ETFs, citing concerns that fund managers would be unable to guard investors from manipulation and fraud within the crypto markets. The cryptocurrency market remains to be largely unregulated, and the SEC has emphasised the need for robust safeguards to ensure fair and transparent trading practices. Crypto ETFs—a type of exchange-traded product—enable you to add crypto exposure to your investment portfolio. Like typical ETFs, they are traded on exchanges and held in traditional brokerage accounts. One of the largest advantages of a crypto index fund is diversification. By investing in an index fund, merchants can gain exposure to a broad range of cryptocurrencies with out having to analysis and purchase every one individually.

Additional Etfs & Mutual Funds

We now offer 19 merchandise throughout a range of codecs, including ETFs, publicly traded trusts, SMAs, and personal funds — providing exposure to over 20 completely different crypto belongings, plus equities, hedge funds, and NFT collections. Diversification is a strategy that involves merchants spreading their portfolio throughout completely different belongings to reduce threat. ETFs are a retail investor-friendly way to achieve exposure to assets which may otherwise be too pricey. Brokers wish to offer ETFs that maintain cryptocurrency in order that average buyers can participate in cryptocurrency investing. However, these funds have a tendency to come back with additional risks and expenses, so it is important to analysis them completely before making an investment choice.

Volatility profiles primarily based on trailing-three-year calculations of the standard deviation of service investment returns. This information will clarify every little thing you need to learn about taxes on crypto buying and selling and income. “Staking,” which allows ether holders to earn earnings by locking up their tokens to assist validate transactions on the community, is a vital function of Ethereum’s consensus mechanism. All corporate names and symbols proven above are for illustrative functions only and usually are not a advice, supply to sell, or a solicitation of an offer to purchase any safety. Past efficiency isn’t any assure of future outcomes and the opinions introduced cannot be considered as an indicator of future efficiency. As of May 2024, the largest crypto ETF is the Grayscale Bitcoin Trust ETF (GBTC), which manages over $17.5 billion in bitcoin.

Vaneck Digital Transformation Etf (dapp)

Investors have swarmed to this digital gold rush, typically with little information and a lot of hope. Any estimates primarily based on previous efficiency don’t a assure future performance, and prior to creating any investment you should talk about your particular funding needs or seek advice from a qualified skilled. As a end result, the Shares of every such Fund when initially bought are restricted and subject to important limitations on transfer and resale.

The objective of this website is solely to show info relating to the products and services available on the Crypto.com App. It is not meant to supply entry to any of such products and services. You could get hold of entry to such products and services on the Crypto.com App. Before accessing the Crypto.com Exchange, please discuss with the next hyperlink and ensure that you are not in any geo-restricted jurisdictions. Investing in virtual currency has produced jaw-dropping returns for some, but the subject still presents risks.

Digital currencies are commonly used in felony activity, such as smuggling or cash laundering, and certain jurisdictions have taken steps to curtail or ban them outright. Major strikes to ban crypto could trigger a steep drop in worth, even if it stays legal in your jurisdiction. The complexity of buying and holding crypto immediately means that many investors both can’t be bothered or won’t have the technical knowledge required. When new funds with historical performance are found, and that fit our criteria for inclusion in the index, they will be immediately added.

Editorial Integrity

The crypto index is adjusted often to mirror the most current market info. Crypto index buying and selling and investing tend to be more beneficial than trading cryptocurrencies because of diversification and cost-effectiveness. Crypto indexes also enable traders to commerce and invest in one instrument rather than worrying about multiple belongings at once. A crypto index can help spread your danger as you will not be uncovered to at least one coin. Crypto indices can also be a preferred approach to give traders targeted publicity to rising or well-liked crypto-economy trends.

Blockchain is a digital ledger that information data—frequently cryptocurrency transactions, although it can deal with any type of data—and distributes it throughout a broad network of pc techniques. BLCN offers a really nicely diversified portfolio of boldface name stocks which are involved in the blockchain economic system. Futures and futures choices trading companies offered by Charles Schwab Futures and Forex LLC. Virtual foreign money is a digital representation of worth and subset of digital foreign money. Cryptocurrency is a subset of digital forex and Bitcoin is a sort of cryptocurrency. Ether is a cryptocurrency that is native to the Ethereum blockchain and network.

Lively Funds

Starting in 2014, asset managers sought approval from the SEC for spot bitcoin ETFs. Between October 2022 and October 2023, the SEC received greater than three,500 crypto-related fund functions. In January 2024, the SEC approved the primary eleven spot bitcoin ETFs, opening the door to more spot cryptocurrency ETFs later. He’s researched, written about and practiced investing for practically 20 years. As a writer, Michael has coated every little thing from stocks to cryptocurrency and ETFs for lots of the world’s major monetary publications, together with Kiplinger, U.S. News and World Report, The Motley Fool and more. Michael holds a master’s degree in philosophy from The New School for Social Research and an extra grasp’s diploma in Asian classics from St. John’s College.

For example, the ProShares Bitcoin Strategy ETF’s expense ratio is 0.95%. For comparability, the expense ratio for the SPDR S&P 500 ETF is just 0.09%. For example, some tokens are available on certain cryptocurrency exchanges while others are not, and exchanges can function in some nations however not others.

For example, regulators are reviewing proposals from fund managers like VanEck, Greyscale, and Fidelity for spot ether ETFs, the digital foreign money native to the Ethereum platform. Those hopes have been born out when spot ETH ETFs were effectively accredited 5 months later. As the cryptocurrency market matures and features mainstream acceptance, crypto ETFs have a central function crypto index funds as buyers need publicity to digital currencies. Below, we talk about the pros and cons of crypto ETFs, the different strategies each kind of crypto aligns with, and their potential rewards and pitfalls.

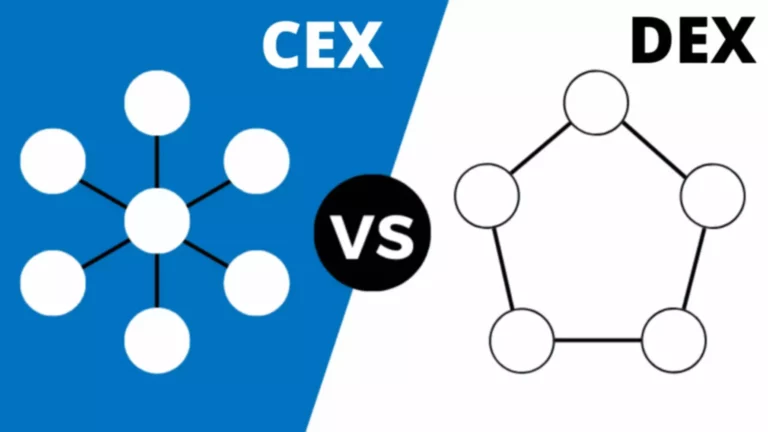

It’s a extra advanced course of, which is why it is primarily carried out by advanced merchants. Another huge difference between most of these funds is the choice you’ll have out there. There are hardly any cryptocurrency index funds in the intervening time, while there are lots of of stock and bond index funds.

Index funds tend to be cheaper than mutual funds as a result of they’re passively managed. The expense ratio is the payment charged by each fund, and it is a percentage of belongings under management. According to the net site, crypto markets behave identical to traditional markets.

Below, we take you thru how these funds work, what worries the SEC still has around these products, what advantages they might have, and what this all means for everyday traders. Blockchain types the backbone of cryptocurrencies like bitcoin and Ethereum, though its applications are far more far reaching, doubtlessly revolutionizing any work that requires database recordkeeping and past. Yes, a futures account is required to trade Bitcoin futures contracts, and sure necessities must be met to commerce futures.

News about Bitcoin and different cryptocurrencies have been inconceivable to disregard. Investors hear news about in a single day millionaires who lose their fortunes simply as quickly. For example, a single bitcoin ranged in price from $1,000 in early 2017 to a excessive of over $66,000 in October 2021, with intense volatility in between. Here are some aspects to consider about cryptocurrency investing generally, as well as variations between investing instantly within the spot market vs. indirectly.

7 Best Crypto Index Funds To Invest in 2023 – CCN.com

7 Best Crypto Index Funds To Invest in 2023.

Posted: Thu, 12 Oct 2023 07:00:00 GMT [source]

Like different such funds, crypto ETFs trade on regular inventory exchanges, and traders can hold them of their standard brokerage accounts. ETFs out there at Schwab provide publicity to spot cryptocurrencies, cryptocurrency futures contracts, and to corporations that are centered on servicing the cryptocurrency market and digital belongings. While most ETFs replicate how indexes work by holding a basket of underlying belongings, crypto ETFs have a couple of methods of tracking the performance of a digital currency. Spot ETFs instantly hold the cryptocurrency, constructing a portfolio that replicates the efficiency of the digital belongings it accommodates. Other crypto ETFs put cash into futures contracts, that are agreements to purchase or sell crypto at a preset date and worth.